Written by Glenna Gonzalez, Professional Marketer and Public Relations

Hey there! Are you a small business owner who is dreading tax season because of all of the paperwork. Look no further, as QuickBooks has you covered. Many business solutions are available online, and choosing the best one for your business can be extremely confusing. The good news is that we collaborated with QuickBooks to make your business life and tax season much easier.

Whether working, in a hurry, or relaxing at your fav café, QuickBooks guarantees that you can manage your business without any hassle. See how you can unlock a new way of flexibility and efficacy while managing your small business with the help of QuickBooks.

Introducing QuickBooks

QuickBooks is not just an accounting software; it’s a tool with many uses beyond accounting. Intuit created QuickBooks, famous among big and small businesses because of its service and revealing features and functions. Business owners must know that their systems and progressions are improving for ground-breaking and growing business opportunities.

QuickBooks offers businesses the success they need in the e-commerce field. This software has a number of features, such as cable online banking, being user-friendly, having remote access, and electronic payment proficiencies. It is accessible in various business markets to help meet the special accounting needs of diverse districts.

QuickBooks provides a variety of accounting solutions and different features for big and small businesses, business accountants, and Freelancers. If you are handling a small business and can’t stand to employ different accountants, QuickBooks is the solution for it. It is a well-known company offering unique bookkeeping programs that you can use to track your financial reports.

There are plenty of reasons for small businesses to use QuickBooks, for instance:

- Saves time: QuickBooks helps in saving time while working on a complex accounting project.

- Low cost: You can handle your business bookkeeping at an affordable price, as QuickBooks offers different price ranges for different businesses.

- Easy data sharing: It helps simplify data sharing by flawlessly integrating with countless huge business apps, including Etsy, Shopify, Amazon, etc.

- Payroll Administration: QuickBooks offers simple payroll administration by offering full- and self-service features.

- Simple Financial Reports: With QuickBooks, you can handle your financial dealings, generate reports, directly print cash flow, see the loss or profit of the business, and get balance sheet reports smoothly for a quick, inclusive outline.

QuickBooks is a key with useful assets to drive your small business with these features and much more.

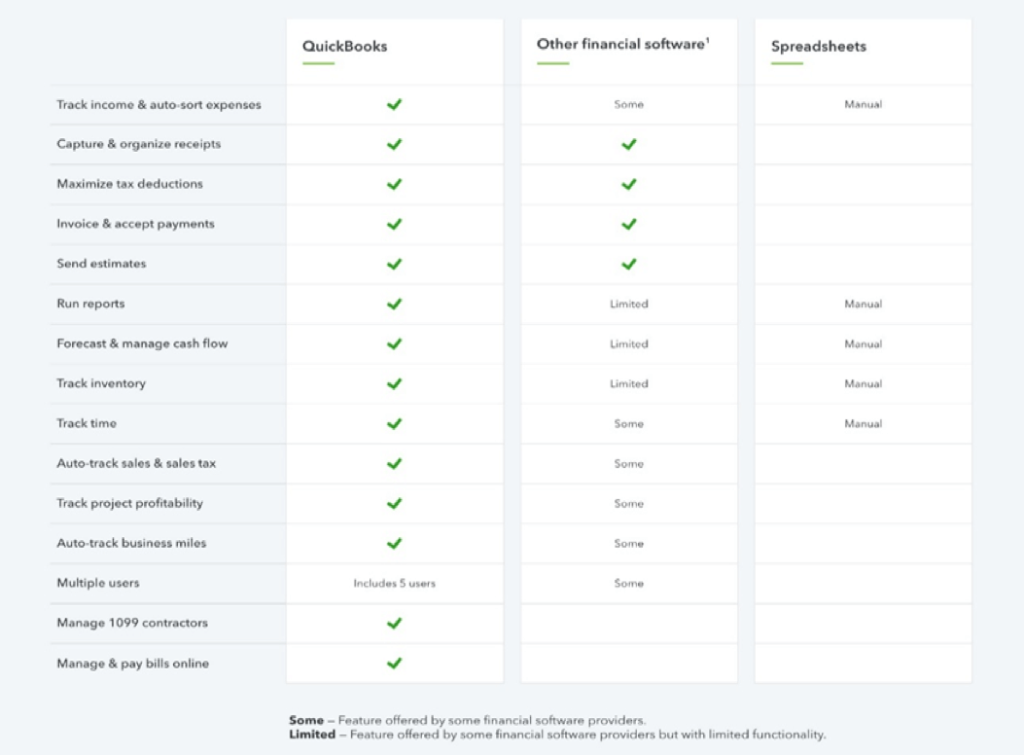

How Does QuickBooks Compare to the Competition?

In rivalry, QuickBooks becomes the dominant focal point, exhibiting its particular elements and separating itself from the group. How about we dig into how QuickBooks stands out in the competitive market?

While contrasting QuickBooks with its rivals, QuickBooks arises as an outstanding decision in light of multiple factors. QuickBooks is easy to understand, user-friendly, has great invoicing and cost following features, consistent combination abilities, and broad client assistance. Its adaptability obliges businesses of all sizes, while its cloud-based availability guarantees adaptability.

QuickBooks has been around for quite some time, is very advanced, and is mostly adored by accountants, particularly in the US market. QuickBooks has an expected 80% piece of the pie in the US. It has been said that clients find a normal $3,534 in charge reserve funds each year by using the service.

QuickBooks is an extraordinary accounting arrangement for simply firing up your business. It’s basic, simple to utilize, and doesn’t need critical accounting information. It has an extraordinary UI and a fabulous across-the-board framework to deal with your essential business accounting needs.

The primary limitations of FreshBooks are its restrictions on users and chargeable clients. all plans offer one user, except the Select tier, which allows for two users; each extra user pays a monthly fee of $11. Five to fifty clients are permitted under the less expensive Lite and Plus programmers, respectively. These constraints might not matter for very small businesses, but they can increase the cost of scaling up while the QuickBooks Online package, Plus, has a five-user limit, and the Advanced plan can accommodate up to 25 users.

Only bank reconciliation tools, recording income and expenses, invoicing, simple reporting, and a mobile app for sending invoices while on the move are included in Wave’s feature set. This might be more than sufficient for freelancers and very small service-oriented businesses. Larger companies, however, might like QuickBooks Online because of its inventory management, configurable bank rules for simpler reconciliation, and transaction tracking tags for more detailed reporting.

QuickBooks Online is the top accounting program for small companies. With more than 70 financial and accounting reports, add-on highlights like finance and accounting administrations, and a huge organization of accounting and accounting experts, this stage is the evident forerunner in the accounting area. QuickBooks manages your accounting with simplicity regardless of the sector in which your company operates. It offers a dependable and intuitive way to simplify the financial aspects of running your company.

See Why Small Business Owners Love QuickBooks

As QuickBooks stays ahead in the competition, it also gives hundreds of reasons for small business owners to love using the application. First of all, small business owners rely on QuickBooks mainly because of its user-friendly interference. Using QuickBooks saves business owners a lot of time and keeps them away from hassle. The auto feature of QuickBooks helps cover many financial tasks, including tracking invoices and expenses, saving precious time for important business dealings. QuickBook’s consistent collaboration tools empower powerful communication with the bookkeepers, creating a very smooth financial administration process.

Another reason for user satisfaction is that this platform goes above and beyond by providing users with timely updates and alerts regarding modifications to tax regulations. The instinctive features of QuickBooks, like tracking taxes and reporting on time, streamline the filing process by helping decrease penalties or any mistake that can occur during the procedure. This software helps small business owners focus on their business strategies and growth and not waste their time fixing tax issues as QuickBooks handles it for them. This commitment to broad financial management and adaptability to propelling obligations makes QuickBooks an irreplaceable large or small business accomplice, empowering steadfastness among business visionaries who regard capability and precision in their financial tasks.

Numerous business proprietors lean toward QuickBooks because of its solid marketing highlight, which gives a versatile and individualized way to oversee ensuing financial exchanges. Business owners can fit their financial history in line with their remarkable necessities by making custom marks for exchanges like deals, costs, and bills. This customization empowers the production of custom reports, giving further knowledge into the regions where the business makes income or causes expenses.

Considering these redesigned labels, the ability to conveniently look at and track trades adds granularity and viability to financial organization. Essentially, this feature engages business owners to have a nuanced understanding of their financial management, adding to a more taught route and everyday business accomplishment.

Furthermore, QuickBooks suggests deals and charges rates for you based on what you are marketing, when you’re marketing, where the business is, and where your client is located. If you have a special state of affairs and need more adaptability in your rates, QuickBooks allows you to utilize your own rate. QuickBooks is loved among business owners because:

- It manages your outgoing payments with BillPay

- Allows you to gain control of your business cash flow

- It helps in tracking and organizing your business transactions

- Helps your business conquer sales tax

- Easy to access from anywhere

As we can see from the positive reviews of the people who have used QuickBooks, it is clear why business owners choose QuickBooks as their go-to software for accountant business handling.

Conclusion

As we come to an end, it is clear that QuickBooks is the one-stop solution for all your business problems. QuickBooks is the ultimate choice for small or big business owners as it offers a complete feature and function set that streamlines their financial administration. From efficient robotization to customized labeling for insightful tracking, QuickBooks engages entrepreneurs with productive and adjustable arrangements while staying ahead of competitors.

Take a step towards improving your small business’ financial effectiveness. Regardless of your industry, rest assured that QuickBooks can seamlessly manage your books from anywhere. Don’t hold back, use our link to purchase QuickBooks and start a journey of continuous financial management and progress without missing out on the exclusive discount!

These are 3 Steps that Small Business Owners Can Follow to Get Started:

- Organize Financial Records:

- Ensure that all financial records, including income and expense receipts, invoices, and bank statements, are accurately recorded and organized in QuickBooks. Categorize transactions properly to make it easier to generate accurate financial reports.

- Reconcile Bank Statements:

- Regularly reconcile your business bank and credit card statements with the transactions recorded in QuickBooks. This helps identify any discrepancies or missing transactions, ensuring that your financial records align with actual bank activity.

- Financial Reports:

- Utilize QuickBooks’ reporting features to generate financial reports inclusive of profit and loss statements, balance sheets, and cash flow statements. Reviewing these reports provide valuable insights into your business’s financial health.